Intro

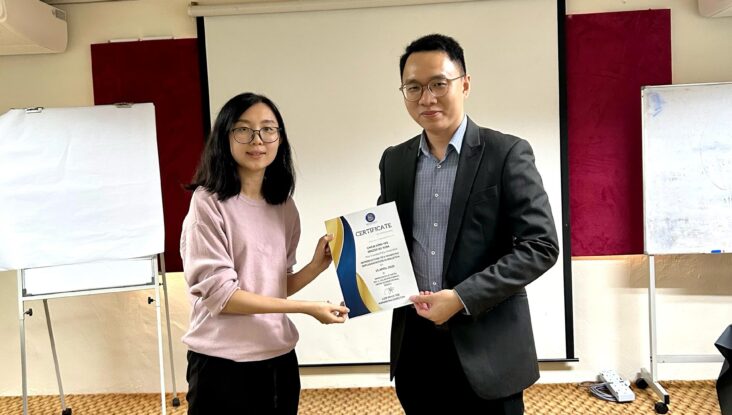

Implementation of E-invoice Training

Malaysian Inland Revenue Board (“MIRB”) recently released the updated version of E-invoicing

General and Specific Guidelines, version 4.0. With mandatory enforcement beginning in August

2024 for businesses that record a turnover of RM100 million per annum and July 2025 for all

businesses, many businesses may find it challenging to maintain “business as usual” while

transitioning to full e-invoicing implementation. To ease this transition, the Government has

granted businesses a 6-month interim relaxation period from the date of mandatory

implementation. During this 6-month interim relaxation period, the Government will permit

taxpayers to use consolidated e-invoices for all activities and transactions and consolidated self-

billed e-invoices for all self-billed circumstances. Following to the announcement of the 6-month

interim relaxation period and the proposed relevant tax incentives such as accelerated capital

allowance claim during Budget 2025, it would seem that the final phase of e-invoicing

implementation shall be concluded on 31 December 2025. As such, it is essential to businesses

to understand the compliance obligation and data requirements, assess the potential

investment costs, and mitigate the risk of non-compliance. E-Invoicing implementation is just

the beginning. Businesses should start planning a robust internal defense to ensure ongoing tax

compliance and readiness for audits.

Full House 50 participant Attendance

Implementation of E-invoice Training

COURSE OBJECTIVES

To empower participants with fundamental knowledge e-invoice and practical aspects with

regards to finance and operational aspects.

More Questions